Yearly depreciation formula

Total yearly depreciation Depreciation factor x 1 Lifespan of asset x Remaining value To calculate this value on a monthly basis divide the result by 12. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

A Complete Guide To Residual Value

The SYD function calculates the sum - of - years digits depreciation and adds a fourth required argument per.

. Same Property Rule. The syntax is SYD cost salvage life per with per defined as. A regulation relating to IRA rollovers stipulating that whenever a financial asset is withdrawn from a retirement account or IRA for the purpose of funding a.

In April Frank bought a patent for 5100 that is not a section 197 intangible. Annual Depreciation Cost of Asset Net Scrap ValueUseful Life Annual Depreciation 10000-10005 90005 1800year Annual Depreciation Rate Annual. Sinking fund or Depreciation fund Method.

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. He depreciates the patent under the straight line method using a 17-year useful life and no salvage value. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime. Current Year PPE Prior Year PPE CapEx Depreciation Since CapEx was input as a negative the CapEx will increase the PPE amount as intended otherwise the formula would. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

Annual depreciation Depreciation factor x 1Lifespan x Remaining book value Of course to convert this from annual to monthly depreciation simply divide this result by 12. The depreciation amount changes from year to year using either of these methods so it more complicated to calculate than the straight-line method. If you use this method you must enter a fixed.

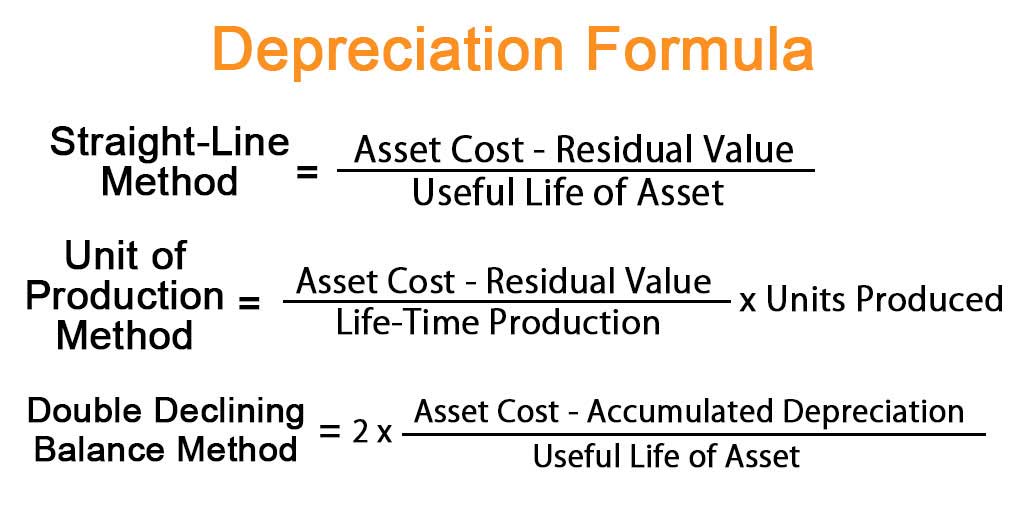

Depreciation Cost of asset Residual Value x Annuity factor. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Under this method we transfer the amount of depreciation every.

Depreciation Rate Formula Examples How To Calculate

Accumulated Depreciation Definition Formula Calculation

What Is Accumulated Depreciation How It Works And Why You Need It

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Formula And Calculation Excel Template

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Annual Depreciation Of A New Car Find The Future Value Youtube

Declining Balance Depreciation Double Entry Bookkeeping

Depreciation Expense Calculator Store 58 Off Www Ingeniovirtual Com

Macrs Depreciation Calculator With Formula Nerd Counter

Straight Line Depreciation Formula Guide To Calculate Depreciation

Straight Line Depreciation Formula And Calculation Excel Template

5 2 Ex 1 Financial Maths Depreciation Youtube

Depreciation Formula Calculate Depreciation Expense

Exercise 6 5 Compound Depreciation Year 10 Mathematics

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculation